Student Debt & Crypto Investing

Summary

Debt Could Be a Good Thing or a Bad Thing Depending How You Use It

A Crypto Investing Portfolio Should Consist of Minimum 90% Bitcoin

Bullish Signal on Bitcoin and Cryptocurrencies As a New Investment Market Emerges

Background

Bitcoiner,

This is a longer article than typical. Most of it is about student debt and using debt to your advantage. Bitcoin & Cryptocurrency investing gets tied into it at the end. Feel free to let me know if you like in depth articles like these in the comments section below. Hope you enjoy!

I am not a financial advisor. Please do your own research on the topic of Student Debt & Crypto Investing.

I believe the idea of debt is a major barrier for most young investors to start their investing careers. Smart investors make money based on the idea of debt. Before I dive into student debt and how it can actually help you as an investor to build wealth, let me explain the difference.

Debt (noun) - something, typically money, that is owed or due.

Uneducated Idea of Debt - using debt as a limiting factor to investing.

Educated Idea of Debt - using debt as a promoting factor to investing.

Quick Story

In Spring of 2018, I was in my last semester of college as a 22 year old getting ready to graduate from Penn State University. Like many of my peers, I was staring at a pile of student debt knowing I had to get ready to start paying it off soon. Luckily, my student debt pile was manageable at around $12,000 total (not including interest). I took out a government backed loan for $12,000 with a monthly payment schedule over 20 years.

I remember having a phone call with my older brother about my student debt situation that went something like this:

ME: “Wouldn’t it make sense for me to pay off the total amount of my student debt with my savings after a year of working?”

BROTHER: “Why that doesn’t make much sense?”

ME: “Well, I figured I could pay it off in one year rather than 20 years. I could also save money by not paying the interest that accumulates over the 20 year payoff schedule. I do not want to have to worry about this debt the rest of my life.”

BROTHER: “I am still paying my student loans from nearly 20 years ago.”

That is when it clicked for me. My brother, a somewhat wealthy entrepreneur and investor, understood debt more than I did.

I had an uneducated idea of debt while my brother had an educated idea of debt. It took me some time to transition from an uneducated idea of debt to an educated idea of debt, but the general thesis of creating wealth from debt was sparked.

Let’s Dig in

Using Debt to Your Advantage

There is a difference between good debt and bad debt.

Student loans can actually be a form of good debt depending how you intend to pay the loan off. What makes student loans a type of good debt is if they are very low interest (2%-4%) backed by the government.

Good student debt increases your wealth over time if you make minimum payments on a low interest loan and use the remaining funds to invest in appreciating assets.

I am describing an educated idea of debt.

Using Debt to Your Disadvantage

There is a difference between good debt and bad debt. Student loans can actually be a form of bad debt depending how you intend to pay the loan off. What makes student loans a type of bad debt is if they are medium to high interest (5% or more) backed by one or more privatized organization(s).

Bad student debt decreases your wealth over time in several ways:

High interest payments compound greatly over the length of a long term loan. By the end of your payoff schedule, you will nearly pay as much interest equal to the original principal amount of the loan.

Making minimum payments on a high interest loan and using the remaining funds to invest in depreciating assets will make you a debt slave.

I am describing an uneducated idea of debt.

Side Note: if your student debt is comprised of both low interest and high interest loans, it is most likely a good idea to payoff the high interest (5% or more) loan first.

Example of Good Student Debt

Bill lands a job directly after graduating from college starting at $50,000 per year salary ($4,167 per month salary).

Bill has student loans totaling $100,000 backed by the US government at a 3% interest rate. His loan is subjected to a 20 year payoff schedule. The minimum payment is $555 per month. Below is a typical payoff schedule if Bill decides to make the minimum monthly payment on their loan over 20 years.

When it comes time to start paying the loan off, Bill decides to educate himself on the idea of debt. After paying the minimum $555 amount each month and paying normal living expenses, Bill has $1,000 leftover each month to invest in an appreciating asset. In this example, Bill has $12,000 each year available to invest

Bill decides to invest his available $1,000 cash each month into the S&P 500 stock index. The S&P 500 stock index appreciates around 10% per year.

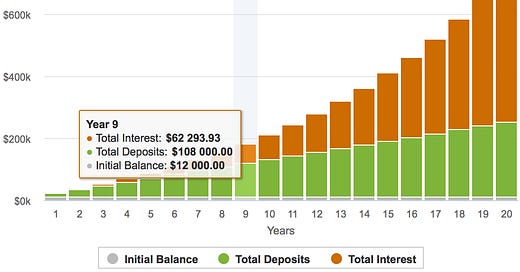

Below is the compounding gains Bill will make each year by investing in an appreciating asset.

* Assumes $0 initial balance, $1,000 deposit made at the end of each month over 20 years without taking inflation into account *

Now here comes the “Aha!” moment.

Scroll up to the Loan Balance Over Time graph above and look at the loan balance around Year 2029. After 9 years of making $555 minimum monthly payments into his loan, Bill’s loan balance is around $65,000.

Next, scroll up to the compounding interest graph and look at the total interest Bill made by Year 9. Over 9 years of depositing his extra investing cash into the S&P 500 stock index, Bill deposited $108,000 of his money, which earned him $62,293.

In Year 9, Bill can completely pay off his student loan if he wants to while keeping his original deposit up to that point.

Bill educated himself on the idea of debt. Bill slowly invested month after month into an appreciating asset while making minimum payments on his low interest student loan. Bill reduced his student loan payoff schedule from 20 years to 9 years.

Bill made money work for him.

Why is this Important?

The example above makes various assumptions, but the basic lesson is still there. You can turn your student loan debt into good debt and reap the rewards.

Educate yourself on debt to turn a dreadful student loan into a manageable situation.

After you educate yourself on debt, try investing some extra money into Bitcoin & other Crypto-related assets.

I usually recommend my friends create a Crypto investing portfolio. Below is a simple breakdown to a Crypto investing portfolio. It has worked very well for me over the past 4 years since I originally began investing in Crypto.

Bitcoin - 90%

Ethereum - 5%

All Other Cryptocurrencies - 5%

So if you want to start a Crypto investing portfolio with $100. Try buying $90 worth of Bitcoin, $5 worth of Ethereum, and $5 worth of other Cryptocurrencies such as Chainlink, Binance Coin, or Cardano. Google is your friend here when it comes to understanding other Cryptocurrencies

Hoodie Crypto tries to help new investors take the time to understand debt and apply it in their own lives. The average person will not take the time to educate themselves and will never get themselves out of student debt. If you have student debt, here is your chance to get out of the hole. Create a Crypto investing portfolio. Most importantly, buy Bitcoin!

Visit the Hoodie Crypto website to educate yourself further.

Happy Monday,

-Pod

BUY BITCOIN RIGHT NOW

I personally use Swan Bitcoin to purchase Bitcoin! Use the link below to get $10 free dollars worth of Bitcoin. Takes less than 5 minutes to sign up.

If you find any value in The Bitcoin Letter, please subscribe and tell a friend. By subscribing, you will be sent easy to understand information about Bitcoin along with any relevant news daily. That’s it. IT IS FREE AND I WILL NOT SPAM YOU!

Eric Podwojski

Founder, Bitcoin EDU

Twitter: @epodrulz