How Bitcoin Fixes Inflation

💡 Daily Reminder: Stay humble, stack sats

Bitcoiners,

Noticeable price increases for everyday items have more and more people talking about inflation recently.

Here is an overview of Bitcoin's inflation rate as compared to the US dollar inflation rate so you can better understand how Bitcoin is fixing money.

What is Inflation?

The definition of inflation according to Brittanica is:

Inflation (economics) - collective increases in the supply of money, in money incomes, or in prices.

Inflation has many definitions in academia. To put inflation in simple terms, it is the rise in prices. One way to calculate and measure inflation is by using the Consumer Price Index (CPI). CPI is calculated by dividing the cost of products or services in a current period by the cost of the same products or services in a previous time period.

The Problem

Inflation is caused by too many dollars chasing too few goods.

The US government reports the dollars CPI as 8.2% in September 2022, however, more realistic estimates show true price inflation is upwards of 20%. The more recent spike in inflation is a direct result of excessive amounts of new dollars added into the global monetary system from the government's response to Covid-19 in 2020. The problem is that it is impossible to predict what inflation will be like in the future while the creation of money is controlled by the Federal Reserve.

Bitcoin's Inflation

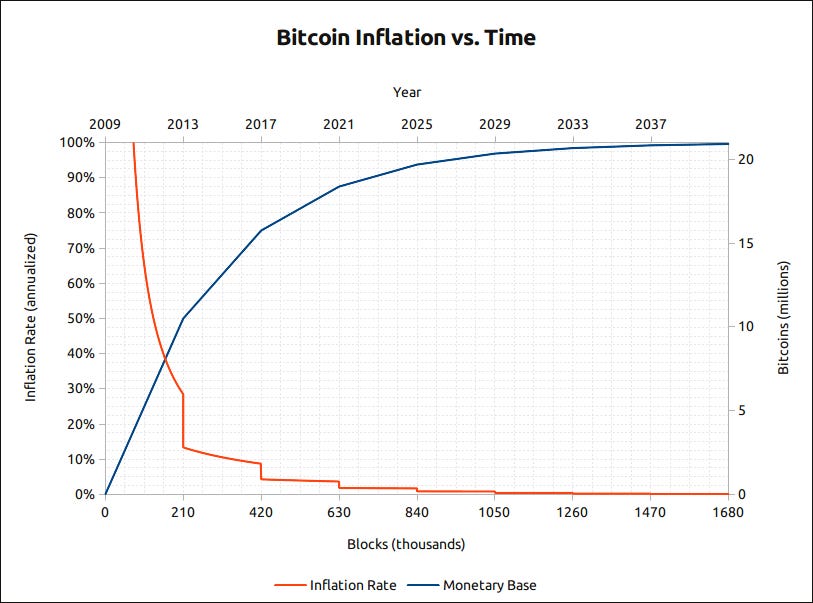

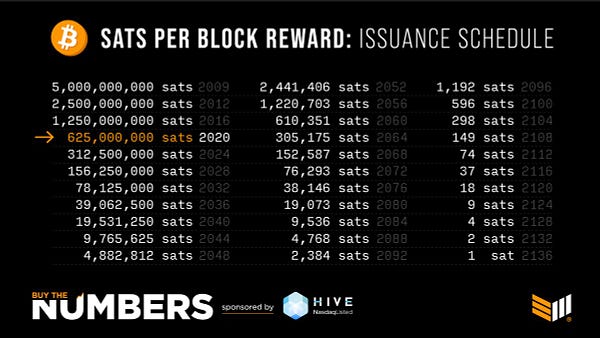

Bitcoin's inflation is controlled by the network itself following a predetermined issuance schedule.

Today, 6.25 newly minted bitcoin are entered into the market every 10 minutes as a reward for mining a new block. This translates to an inflation rate of 1.79% per annum. Bitcoin's inflation rate will continue to decrease after every 210,000 blocks are mined (approximately every 4 years) until all of the total bitcoin to exist equals 21 million in the year 2140.

Significance

Bitcoin presents a solution to inflation because it has a fixed issuance monetary policy as compared to the current fiat monetary system's unknown policy.

Bitcoin's 1.79% inflation rate is significantly better than the dollar's current 8.2% rate. Imagine planning for future expenses and being able to know how much prices will increase (or decrease) year over year because you know Bitcoin's predetermined issuance schedule will not change. On a Bitcoin Standard, prices at the grocery store will continue to drop year over year. Rather than be at the mercy of the US dollar's unknown future inflation rate, you can opt into a system in which the inflation rate is known and predictable.

Happy Friday,

-Pod

PS. I am in Zion National Park this weekend :)

If you find any value in The Bitcoin Letter, please subscribe and tell a friend. By subscribing, you will be sent easy to understand information about Bitcoin along with any relevant news daily. That’s it. IT IS FREE AND I WILL NOT SPAM YOU!

BUY BITCOIN RIGHT NOW

I personally use Swan Bitcoin to purchase Bitcoin! Use the link below to get $10 free dollars worth of Bitcoin. Takes less than 5 minutes to sign up and I get a small commission :)

Eric Podwojski

Founder, Bitcoin EDU

Twitter: @epodrulz

Disclaimer: This should go without saying: This is not financial advice. This is not investment advice. I write this newsletter for education and entertainment. Act accordingly.