💡 Daily Reminder: Stay humble, stack sats

Bitcoiners,

Bitcoin's store of value and monetary attributes make it a prime contender to overtake the largest pools of existing wealth.

So what if it did?

Here is a high-level analysis of each asset class value and an estimate of how much bitcoin would be worth if it consumed a portion of each asset so that you can better understand why one bitcoin could be worth more than $1 million dollars in the future.

Bitcoin's Total Addressable Market

Total Addressable Market (TAM) refers to the maximum size of the opportunity for a particular product or solution.

The TAM for Bitcoin includes:

money

foreign exchange reserves (bonds)

corporate treasuries (stocks)

gold

real estate

Money

For this analysis, let's consider the Global Broad Money M2 supply which is the currency in checking accounts, savings accounts, or cash.

Current estimates suggest there are about $60 trillion dollars floating around the world including developing and developed countries.

Assuming Bitcoin's use case as currency took over 5% of that $60 trillion dollars, one bitcoin would be worth $176,000.

Foreign Exchange Reserves

Foreign Exchange Reserves are assets held by central banks in a given country including foreign currencies, bonds, treasury bills, and other government securities.

Current estimates suggest there are about $12 trillion dollars stored in foreign exchange reserves from 180+ countries around the world.

Assuming Bitcoin's use case as a store of value took over 5% of that $12 trillion dollars, one bitcoin would be worth $35,000.

Corporate Treasuries

Corporate Treasuries are shares of a company held privately by the company itself or offered on the public market commonly referred to as a stock.

Current estimates suggest there are about $38 trillion dollars stored in corporate treasuries around the world.

Assuming Bitcoin's use case as a store of value took over 5% of that $38 trillion dollars, one bitcoin would be worth $111,000.

Gold

Gold has naturally emerged as the apex of sound money over the past few thousand years to store wealth.

Current estimates suggest there are about $10 trillion dollars stored in gold around the world.

Assuming Bitcoin's use case as a store of value took over 5% of that $10 trillion dollars, one bitcoin would be worth $29,000.

Real Estate

Real Estate including land, single-family homes, multi-units, and commercial property has recently become an asset class in which people store their wealth.

Current estimates suggest there are about $250 trillion dollars stored in real estate around the world.

Assuming Bitcoin's use case as a store of value took over 5% of that $250 trillion dollars, one bitcoin would be worth $740,000.

1 Bitcoin = $1 Million Dollars

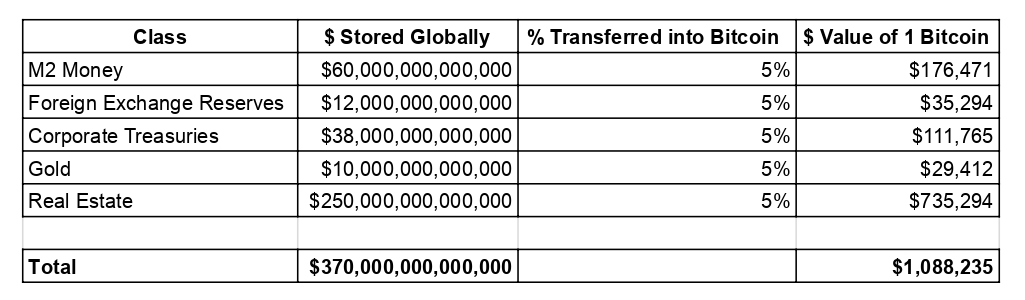

I put together a spreadsheet that calculates the value of 1 bitcoin for each class that is part of Bitcoin's TAM. Feel free to edit the % Transferred into Bitcoin column to see how the numbers change.

Assumptions include:

17,000,000 bitcoin in supply (estimating ~4 million lost)

5% takeover of each class into bitcoin

This does not include the current price of bitcoin of ~17,000

Although this is a rough calculation to reach $1m per bitcoin, it is not too optimistic to expect this to happen over the next 30 years.

Final Thoughts

Bitcoin is often referred to as a black hole because it has the potential of flipping nearly 100% of every class that is included in the TAM.

If that happened over the next 1,000+ years, one bitcoin would be worth over $22 million dollars in today's dollars.

Got enough bitcoin?

Happy Monday,

-Pod

If you find any value in The Bitcoin Letter, please subscribe and tell a friend. By subscribing, you will be sent easy-to-understand information about Bitcoin along with any relevant news daily. That’s it. IT IS FREE AND I WILL NOT SPAM YOU!

BUY BITCOIN RIGHT NOW

I personally use Swan Bitcoin to purchase Bitcoin! Use the link below to get $10 free dollars worth of Bitcoin. Takes less than 5 minutes to sign up and I get a small commission :)

Eric Podwojski

Founder, Bitcoin EDU

Twitter: @epodrulz

Disclaimer: This should go without saying: This is not financial advice. This is not investment advice. I write this newsletter for education and entertainment. Act accordingly.